Earlier we looked at financial packages for the Linux Operating System, and as a follow up we would like to take a look at some solutions for the Mac user. After all, Macs are a very popular alternative to a Windows based machine, and they are, according to the published numbers, the most popular Unix based personal machine.

There are several very capable financial apps for a Mac, but the best fit may vary based on your particular needs. While it could be argued that one of the best financial trackers is a spreadsheet (on Numbers or NeoOffice, for example), a dedicated app gives you simplicity along with added features. So, let’s take a look at some of our picks for your Mac financial software.

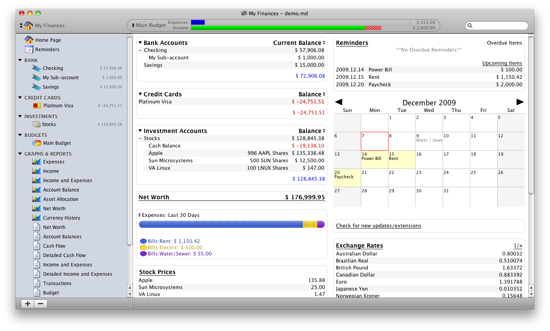

MoneyDance

MoneyDance is a popular option for a financial software solution, and it is available on all major operating systems. Money is feature rich with such things as online banking support, budget managing, and portfolio tracking. MoneyDance incorporates a scheduling system which allows you to set up future or recurring payments. And you can import data from Quicken and Money.

Robust reporting and graphing lets you quickly analyze your situation and how you’re doing, with such reports as budget, missing checks, net worth, account balances, cash flow, cost basis, and more. You can set up favorite reports and access them with a single click.

MoneyDance will encrypt your data for peace of mind with a user supplied password. And finally since MoneyDance uses standard technologies as OFX, QIF, SSL/TLS, Java, and XML you won’t find yourself locked out of your data.

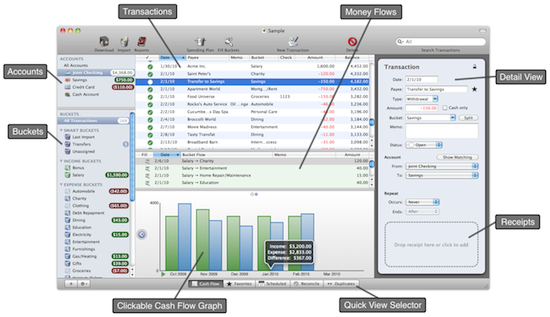

iBank

iBank is probably the most Mac-ish financial package on this list – in its look and feel. You have three ways to view your data – a standard ledger view, a ledger view with pictures, and finally a unique cover flow view. In fact, iBank is so much into look and feel that it ships with its own clip art, allowing you to assign icons to common transactions (which makes sense, given the cover flow view).

You can also manage your portfolios with iBank, and you can download transactions directly with banks that support OFX (which is the most common format). iBank also has the standard collection of reporting tools, and a drag and drop interface makes it easy to use.

If you have an iPhone, the iBank mobile app makes it easy to keep accounts straight. You can record transactions on the go and sync later with your laptop through WiFi, MobileMe, or WebDAV. And iBank supports many different currencies and allows you to to convert between them as needed.

MoneyWell

MoneyWell is a financial software package for a mac that hosts a wide array of features in an easy to manage single window. MoneyWell is strong on budgeting, with virtual “buckets” to replace the common envelope approach (Dave Ramsey fans might like this). The bucket approach also makes it easy to analyze and look up transactions, since finding “dining” transactions only requires clicking on the so assigned bucket.

MoneyWell will direct download transactions from most banks, and it can schedule transactions to keep you ahead of the bills. It will also help you with budgeting by monitoring pertinent buckets, and will display them as close to tipping over when you exceed a set amount. This lets you see how you are doing (and how much you have left to spend) with a quick view of your various buckets.

MoneyWell also makes it simple to reconcile checking accounts with a dedicated fix button, and the interface provides a very simple means of managing cash flow.

Squirrel

Squirrel is an easy to use financial package for the Mac that can also be used on the iPhone (app available separately for free) and synced over WiFi. This makes it simple to record transactions when on the road and keeping it straight for later.

Squirrel offers reports and graphs to let you analyze your spending, and it also has a unique history graph to allow you to view an account over time. The history graph also makes it easy to select transactions for a given period. Squirrel also offers scheduled transaction and budgeting tools for keeping your finances in check.

Squirrel supports importing of OFX, QIF, and CSV files, but it will not connect to a bank directly. Some users may find this as a deal breaker, but many prefer to monitor their banking transactions directly. Another cool feature unique to Squirrel is support for smart folders, which allows you to filter transactions based on your supplied criteria.

Quicken Essentials for Mac

Quicken Essentials For Mac would appear to be a natural choice for Mac users, especially given their history and following on other platforms. However, Quicken for Mac in the past has been ill received by users, and the software appeared to always miss the mark. For 2010 the interface has been redesigned, but the word on the street (okay, the reviews I could find online) does not hold encouraging support for the latest and greatest version.

Perhaps it is that Quicken is offering too little in their Mac software. To be fair, the name does include “essential” in the title, which would suggest that there is not a lot of frills. But perhaps a paragraph from the quick start guide will sum it up best:

Quicken Essentials does not include many of the advanced features in other versions of Quicken, including Business features, Rental Property, lifetime planner, cash flow forecast, spending plan, debt reduction plan, emergency tax records, tax planner, and home inventory manager.

So, with that said, if you need a basic financial package with a big name behind it, then take a look at Quicken Essentials for Mac. Otherwise, move on along.

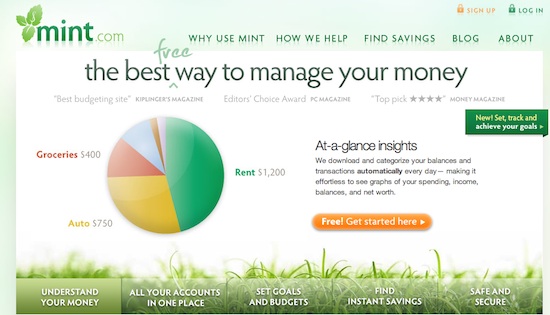

Mint

Any discussion of software today would probably need to include at least a mention of a cloud based solution, and for financial solutions we do need to mention Mint. Mint is a free service that allows you to track your financial information from almost any computer and still keep it in sync. And if you have an iPhone or Android smartphone, then you can download the free app and keep things straight on the go.

Mint has all the tools you’ve come to expect from a standard financial package, including investment tracking, graphing, reporting, goal setting, and budgeting. The service incorporates encryption that is monitored by TRUSTe, VeriSign, and Hackersafe. What’s more, Mint has no personal information about its users, and the service is read only, meaning that it cannot be used to move money out of accounts.

Once set up, Mint will automatically access your bank transaction information (again, read only) and import it for your use later. This keeps Mint up to date without any need of intervention on your part. It will also do the same for your investments, making it a handy one stop place to anonymously see your financial picture. And finally, Mint can alert you via email or text for a variety of conditions, including low account balances, budget overages, overdrafts, and more.

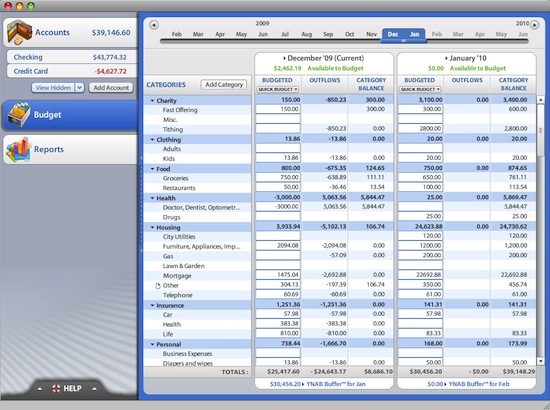

You Need A Budget (YNAB)

You Need A Budget (YNAB) is a capable solution that is heavy on the budgeting side of financial software, as the name would suggest. It is tied to a money management methodology, which incorporates four simple rules:

- Rule 1: Stop Living Paycheck to Paycheck

- Rule 2: Give Every Dollar a Job

- Rule 3: Save for a Rainy Day

- Rule 4: Roll With the Punches

As with MoneyWell above, YNAB makes use of a virtual money envelope system to track you finances, and lets you easily save for large purchases. YNAB can import directly from your bank, and it will allow you to schedule upcoming and recurring transactions. YNAB is a great tool for anyone interested in getting out of debt (Did I mention Dave Ramsey yet?), and it even includes free online budgeting classes to help along the way.

As you can see, there are many very capable financial products for a Mac. Depending on what your needs are (such as strong budgeting, debt elimination, cloud centric location, or automatic transaction downloads), you can find something to like about one or more of those listed above. They all offer trials, so you can try them out and see what works best for you.

2 comments for “Mac Money – Financial Software for your Mac”