So what’s the new name going to be? T-Metro? T-PCS? How about Metro Mobile, I like that one! Anyway, yes the T-Mobile and MetroPCS merger is complete and I’m sort of sad about it as that just eliminates more competition and competition is a good thing for consumers, at least I thought it was. Oh well, it’s done, it’s official, read all about, full announcement with all the boring financial stuff is all included below..

Deutsche Telekom AG (XETRA: DTE; “Deutsche Telekom”) and T-Mobile US, Inc. today announced the completion of the combination of T-Mobile USA, Inc. and MetroPCS Communications, Inc., uniting two wireless innovators with one common vision: to bring wireless consumers exciting new choices while delivering an exceptional experience. The combined company, T-Mobile US, Inc., will begin trading on the New York Stock Exchange today under the ticker “TMUS.”

“The combination of T-Mobile and MetroPCS creates an even stronger disruptive force in the U.S. wireless market,” said John Legere, President & Chief Executive Officer of T-Mobile US, Inc. “Together, as America’s Un-carrier, we’ll continue our legacy of marketplace innovation by tearing up the old playbook and rewriting the rules of wireless to benefit consumers.”

As previously announced, the Board of Directors of the combined company will have 11 members, including two directors of MetroPCS who will continue with the combined company. Tim Höttges, currently Deputy Chief Executive Officer and Chief Financial Officer of Deutsche Telekom, will serve as Chairman of the Board.

“By uniting T-Mobile and MetroPCS, we have created a dynamic new player in the wireless industry that has the right strategy and management team in place to compete successfully in today’s marketplace,” said Mr. Höttges. “We look forward to realizing the tremendous potential of the new T-Mobile.”

A few facts about America’s Un-carrier:

2012 combined entity results would have reflected $24.8 billion of revenue, $6.4 billion of adjusted EBITDA1, $3.7 billion of capital expenditures (excluding spectrum purchases)2, and $2.7 billion of free cash flow3.

Approximately 43 million subscribers as of March 31, 2013, two exceptionally strong brands, and 70,000 customer touch points.

A wider choice of outstanding wireless devices, including iPhone, offered through simple, affordable rate plans for unlimited talk, text, and Web – with no restrictive annual service contracts required.

The combined company’s total PoP coverage is 301 million, of which 283 million are covered by owned network. 228 million are currently served with 4G and 200 million are expected to be covered with 4G LTE by the end of 2013.

An enhanced spectrum position that will provide greater network coverage and deeper 4G LTE coverage in key markets across the country. Combining the two companies’ spectrum provides a path to at least 20+20 MHz of 4G LTE in approximately 90% of the top 25 metro areas in 2014 and beyond.

Target five-year (2012 – 2017) compounded annual growth rates in the range of 3% – 5% for revenues, 7% – 10% for EBITDA, and 15% – 20% for free cash flow.

Projected cost synergies of $6 – $7 billion (net present value4), with additional potential upside from the focused geographic expansion of the MetroPCS brand.

Under the terms of the business combination agreement, MetroPCS effected a 1 for 2 reverse stock split, made a cash payment of $1.5 billion to its stockholders (approximately $4.05 per share prior to the reverse stock split), and acquired all of T-Mobile’s capital stock from Deutsche Telekom in exchange for approximately 74% of MetroPCS’ common stock on a pro forma basis.

The combined company is headquartered in Bellevue, Washington and maintains a significant presence in Richardson, Texas. The combined company will be led by President & Chief Executive Officer, John Legere, with former MetroPCS Vice Chairman and Chief Financial Officer, J. Braxton Carter, serving as CFO. As previously announced, the combined company will operate T-Mobile and MetroPCS as separate brands, led by Jim Alling and Thomas Keys, respectively, migrating to a common network infrastructure and with common support functions.

To mark the successful completion of the transaction, Mr. Legere and several customer-facing employees will ring the Opening Bell of the NYSE today, May 1, 2013.

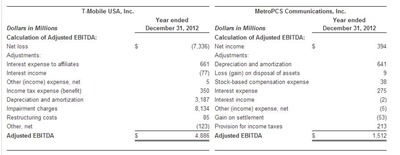

Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures (Unaudited)

Information regarding the 2012 combined revenues, adjusted EBITDA, capital expenditures (excluding spectrum purchases), and free cash flow for the combined company is presented for informational purposes only. These combined company measures represent the sum of these financial measures for each company in 2012. They are not intended to represent or be indicative of the results of operations or financial position of the combined company had the business combination been consummated on January 1, 2012, and should not be taken as representative of the future results of operations or financial position of the combined company. This press release includes non-GAAP financial measures. The non-GAAP financial measures should be considered as a complement to, but not as a substitute for, financial information determined in accordance with GAAP.

1 The following tables illustrate the historical 2012 calculations of Adjusted EBITDA for T-Mobile USA, Inc. and MetroPCS Communications, Inc. and reconcile Adjusted EBITDA for each company to each company’s net (loss) income, which T-Mobile considers to be the most directly comparable GAAP financial measure to Adjusted EBITDA.

2 Capital Expenditures (excluding spectrum purchases) represent the sum of each company’s capital expenditures (excluding spectrum purchases) for 2012.

3 Free Cash Flow represents Adjusted EBITDA for each company (as calculated above) less Capital Expenditures (excluding spectrum purchases) for each company.

4 NPV is calculated with a 9% discount rate and 38% tax rate.

Other, net for the year ended December 31, 2012 represents a net gain on an

AWS spectrum license purchase and exchange, transaction-related costs

incurred for the terminated AT&T acquisition of T-Mobile, and transaction-

related costs incurred from the proposed business combination with MetroPCS

Communications. Other, net transactions may not agree in total to the other,

net classification in the Consolidated Statements of Operations and

Comprehensive Income (Loss) due to certain routine operating activities, such

as insignificant routine spectrum license exchanges that would be expected to

reoccur, and are therefore not excluded from Adjusted EBITDA.About T-Mobile US, Inc.

As America’s Un-carrier, T-Mobile US, Inc. (NYSE: “TMUS”) is redefining the way consumers and businesses buy wireless services through leading product and service innovation. The company’s advanced nationwide 4G and 4G LTE network delivers outstanding wireless experiences for customers who are unwilling to compromise on quality and value. Based in Bellevue, Wash., T-Mobile US, Inc. operates its flagship brands, T-Mobile and MetroPCS. It currently serves approximately 43 million wireless subscribers and provides products and services through 70,000 points of distribution. For more information, please visit: http://www.T-Mobile.com